In the battle to stay ahead in the electric car revolution, General Motors is making a bold move. Sources have confirmed that GM is vying for an ownership stake of Vale’s base metals unit which contains copper and nickel – two vital components used in EV batteries. It remains unclear what this potential partnership might mean on a global level but it could be enough to put them at the forefront of sustainable transportation technology going forward.

The automaker has been making strategic investments to secure essential supplies. In recent months, they’ve made two large purchases – investing $650 million into Lithium Americas and acquiring a stake in Queensland Pacific Metals for $69 million. These moves are not only positioning GM as an industry leader but also providing invaluable access to minerals that will be needed for up to 1 million EVs each year from Thacker Pass mine alone.

“We’ll continue to work with many people in the industry, especially in lithium and the other critical minerals,” CEO Mary Barra said in an interview with Bloomberg Television in New York on Feb. 16. “I think we’ll be positioned to have a competitive advantage.”

The Detroit automaker has just announced a commitment to produce only plug-in models by 2035, while also investing in their very own EV platform and battery pack tech rather than riding on existing internal combustion hardware. This year alone will see an exciting ramp up of EV production with Hummer pickup trucks, Cadillac Lyriqs, Chevrolet Silverados and Blazers hitting showrooms across America.

Securing battery-metal supplies could provide a significant boon to the often-volatile sector. Prices for cobalt rose dramatically in 2020 before plummeting due to decreased demand from Chinese electronics producers, while nickel prices skyrocketed briefly above $100,000 per ton earlier this year only to fall below the $30,000 mark by December’s end. Lithium was so sought after last year that factories producing ceramics saw it as a more lucrative option than their usual materials production of bathroom tiles – leading them instead towards making components for electric vehicle batteries.

GM is joining a growing list of major automakers that are investing in the future. Ford has signed long-term supply deals, Germany’s Volkswagen and Belgium’s Umicore announced plans for a 3 billion euro joint venture last year, while early 2021 saw Tesla strike nickel and cobalt deals with BHP Group and Glencore respectively before getting engaged in mining activity on New Caledonia – all part of their commitment to invest heavily towards sustainable transport solutions.

GM’s recent deals with mining companies may give the miners a welcome boost of funds and stable demand. In its plans to sell 1 million electric vehicles by 2025, GM has committed to long-term support for these partners – plus plenty more EVs in the future.

In a time of heightened environmental and human rights awareness, the mining industry is being encouraged to exercise extreme caution. Amnesty International has highlighted the consequences that arise from irresponsible practices in this sector – ranging from ecological disruption to potential violations of people’s basic liberties. Companies like GM must bear these risks closely in mind or risk facing serious reputational damage.

Vale’s corporate image suffered an immense blow when a deadly collapse of the Brumadinho dam in Brazil resulted in 270 fatalities and released hazardous sludge into the environment. This incident cost Vale its coveted rank as world’s largest iron-ore producer, forcing them to undergo extensive safety improvement protocols while facing reparation costs that weighed heavily on their subsequent financial reports.

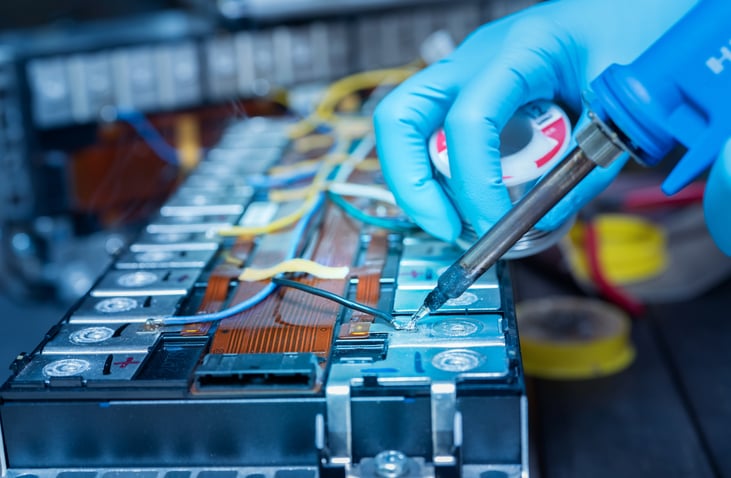

As concerns about environmental sustainability grow, companies are searching for solutions to reduce the impact of mining. GM is leading this effort by investing in two startups: Controlled Thermal Resources and Lithion. The former uses renewable energy sources to extract lithium from ore while the latter recycles EV batteries materials that can be reused elsewhere.

GM is playing catch up in the electric vehicle industry, but CEO Mary Barra has vowed to turn things around. This year will see two new Chevy models debut – the Equinox and Blazer – with starting prices of $30k and 40-45k respectively. GM is hoping these more modest vehicles can help boost their EV standing against market leader Tesla, who outsold them fourfold last year.

“These are very affordable vehicles,” Barra said. “There is going to be a huge opportunity to sell a lot of them.”

Source: Transport Topics